TABLE OF CONTENTS

The process of developing, designing, testing, and launching applications destined for mobile devices is a mobile app development, and it lets a user complete specific tasks using particular specs. Android, iOs, or Windows platforms are typically used to develop mobile apps. It seems easy but in actuality a really difficult process that requires a lot of investment and planning.

The origin of every mobile app is an idea to solve any problem and there is a vast range of options for the goals these mobile apps have. It is a fact that there are so many things for a developer to consider; from market research to technical stack selection and from developing responsive apps to hardware specifications, lots and lots of factors gather up to make the development process. Even, the process continues for testing, deployment, and changes.

This all needs a proper mobile app development plan which lets you implement strategically working criteria. Developing a mobile app requires you to invest heavily in the process, and it is imperative to find investors who are willing to fund the project. Especially startups and entrepreneurs who have the potential to grow must need investment and various investors willingly invest money in these startups as they see growth potential in the long run. These investors are venture capitalists, and their investment is called venture capital. But is it worth looking for venture capital for your app development project?

How to Find Startup Funding For Your App before Jumping Into Venture Capital?

Before you write your app development plan to get venture capital, let’s discuss how you can get startup funding before you find a big investor. There are some of the following easy ways you can go for.

Initiate With Bootstrapping

Bootstrapping is actually funding your app development with your own capital. This is the safest and easiest way to startup finding your application idea. Bootstrapping is best when you don’t want to burden yourself with loans and liabilities. It will be best if anything does not seem to work well as expected.

Ask Friends or Family

Personal networks like friends or family are the most reliable resources to fund your app development project. These are people who believe in you and your app idea and invest willingly in your project to support your venture which might even have potential risks. But it does not mean that you don’t need any solid plan or idea to persuade them for funding. Of course, you will need it. But it’s a lot easier to persuade people in your personal network rather than presenting your idea to a stranger. If your project is on a smaller scale and requires low investment, it is best to ask your friends or family to fund your idea.

You can also use bootstrapping and personal network funding methods to create your app's MVP and then use it to pitch big investors.

Pitch Private Local Investors

Local and private investors are the one-step-ahead method to get startup funding for your app. private investors are actually local business owners who are already working in your app’s niche. If you get a hotel booking app idea, you can contact hotel or resort owners to fund your app development project. Not only will it help you attain your goals, but will also be helpful for them to get a competitive edge.

But this option is only viable if your app’s idea has a niche industry and you have contacts in that industry as well. Also, you must communicate with the business owners effectively to convince them to invest in your project and make an app for them if they don't have one.

Look For Angel Investors

Angel investors are most sought after by those who need app funding. But there are few things that you should be keeping in mind while understanding who they are:

- Angel investors are individuals or businesses or firms who love to invest capital in startups in their development stage to get a share or any other type of affiliation that profits them in the future.

- Don’t get yourself fooled by the term “Angel Investors” and expect that they will fund your project to get nothing in return. However, backing your project's finances through angel investors is way safer and risk-free than any other type of financing like taking a loan from the bank.

- It is also a plus point that angel investors don’t ask their money back if the app’s idea results in a flop project. That is the reason they are called “Angel Investors” and what attracts the most entrepreneurs and startups.

- In case your app is a massive success, you can expect your angel investor to share 10% to 25$ % of revenue shares all depending on how much funding you have acquired.

- Angel investors may have control over your project and they are authorized of your income’s share or in the total worth of your app or project.

- Your family or friends can also become your angel investors as well as private investors—depends on your agreement and terms of funding.

- You can get your angel investors in many forms. You can see angel investors doing crowdfunding, as a business or corporate, or angel investment pools (several investors come together to fund your project and for joint investment)

- In the case of mobile app development projects, angel investors fund startups by keeping great risks in mind. That is why you must perfect your pitching and idea presentation so that your project seems convincing for them.

Consider Contests for App Funding

If you are thinking that you have very few options to get funding for your app, you may be surprised to hear that you can consider app funding contests. There are many contests and competitions of app funding held by corporates, angel investors, and industry leaders every year to invest in promising app development projects. So if you think that you have got a revolutionary app idea with a compiling development plan, you can opt for these funding competitions to get the investment in your project.

These contests not only provide funding but also mentor you in your development journey. The only key to win the contest is to prepare for the competition thoroughly. There will be hundreds of your competitors in the contest and you have to pitch your idea in a most unique way to nail it.

Also, it may be a valuable experience for you to take part in such competitions even if you don't get funding. You may get offers yet from a lot of investors who may find your idea worth investing in.

Now we have gone through some of the basic ways to get the funding for your app, now let’s see what some of the startup funding rounds that you may go through.

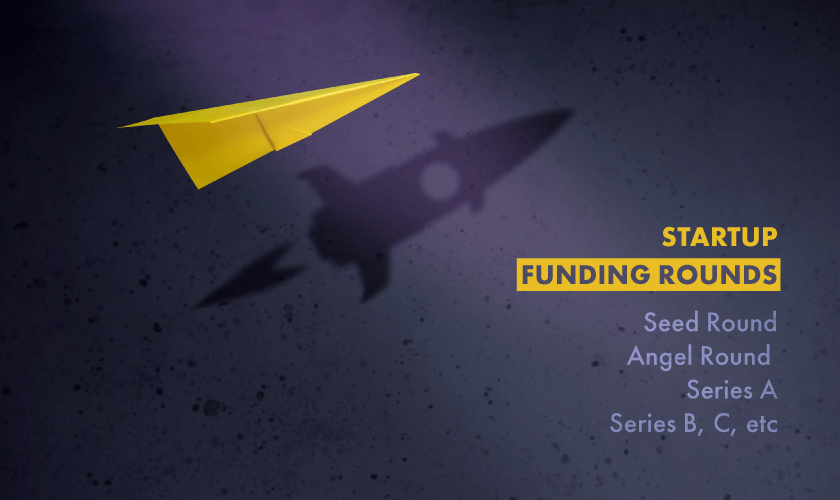

Startup Funding Rounds

You must know the startup funding rounds to write an app development plan to pitch venture capitalists. are structured. Although these funding rounds may vary from individual to individual or investor to investor, the general timeline of funding is as follow:

Seed Round:

This is the earliest round of funding your app as soon as you got an app’s idea. In this stage, you are collecting funds to invest in your project through several methods. Seed funding often comes from inside your startup and usually provides the startup with an initial capital for the development.

Angel Round:

An angel funding round is an exaggerated seed round but in a more formal way. In this round, you invest more capital by hunting some angel investors who are most probably outside investors. These angel investors buy common stocks in your company and provide funding for your app project. This round usually comes with more formal and professional terms and conditions than the seed round.

Series A:

Series A can be considered as the first round of capital funding in an idea on large scale. This stage lets you focus on the growth of your project and startup. Through a series A funding round, you can optimize your startup and app development for scalability through huge investment (Ranging from $2 M to $10 M).

Series B, C, etc.:

If your startup is making it to Series B, C, etc., or beyond rounds, it is your startup’s significant milestone then. Series B funding will continue to expand and grow your app development project and business. It may include funds for full-fledged advertising, consistent product development, and customer support. Funding rounds after Series B (Series C, etc.) let you go public with your startup and expand into new horizons.

How Venture Capital Works

Some startups take several years to grow while they are stuck with the bootstrapping method of funding. Little do they know if done with a strategy, they can pull off venture capital like a pro. The more capital you have, the more you are likely to grow. Venture capital is a blessing whether you’re developing an app or planning a digital startup.

Let’s see how it works for an organization

- Investors go for venture capital investment for a reason

It is imperative to understand why someone would go for Venture Investment? Obviously, there are some incentives one must be getting by lending out money to the startups like app development. Venture Capitalists make their investments and fund the startups to share an ownership percentage in the company. The better the startup performs, the greater profit the venture capitalist gets.

If done right, venture capital creates a win-win situation for everyone.

- Venture Capital is beyond just funding

A venture capitalist (individual or firm) provides funding to a startup on their talent basis. And they just don’t fund the project; they make sure that people working on the project achieve a higher level of success. It means that venture capital is not only about funding; it’s also about the growth of the organization and its people. Venture capitalists not only do fund the startups but also:

- Build their client network

- Provide them guidance in their field

- Offer full-fledged support in the form of management, marketing, and research team.

Venture capital brings all these things with it to increase the success chances of an app development project which is relatively a high-risk game.

- Who receives venture capital?

Any startup that is in the early development stage can get venture capital. Investors who want to "venture" into app startups usually get impressed by the idea. However, keep in mind that not every venture capitalist whether it is an individual or a company is suitable for your startup. So pitching the right venture capitalist is also an important point to consider when you are looking for funding for your app.

- When does venture capital work wonder for a project?

Venture capital funding is effective in case the mutual symbiosis between a venture capitalist and startup is incredible. There are the following factors that make a venture capital work wonders:

- An investor knows your target audience

- Venture capitalist comprehends products or services (app idea, its use, and its benefits)

- Venture capital knows the development stage of your company and what resources you need at what stage.

Make sure that venture capitalists and your project share the same niche so that both may gel-in well. Your project will be successful and VCs are happy in that way as well.

Types of Venture Capital Funding

Venture capital does not necessarily mean a one-time huge investment. It has many forms, and in the case of app development projects, there are many types of venture capital. Some of them are as follow:

Seed Capital

Seed capital is the one that you seek for the very first time before you start your development. it is capital you get based on your app's idea and the very small amount is invested. These seed funds may be used to make mockup apps, market research, or hiring relevant staff.

Startup Capital

Startup capital refers to the very rare funding stage where your MVP is ready as a sample and you want to finalize its launch in the marketplace. Startup capital funding can also be used for extended research for the market, hiring management staff, or finalizing development processes that require attention.

Early Stage Capital

Early-stage capital is the funding that you get when you have developed your app and it's working well. You have a development and management team handy and you have started earning. At this stage, venture capital funding helps you reach the break-even point to improve the productivity of your app startup and increase efficiency.

Expansion Capital

The expansion capital refers to the funding you acquire when your startup is fully grown and you are looking to expand and grow to the next level. You may explore new markets and jaundras or invest in advertising your app through funding at this stage.

How to write a perfect mobile app development plan

Now we have a complete understanding of venture capital and its process. Let's jump into writing a mobile app development plan to pitch the venture capitalists. Here is a step-by-step guide to it.

- Include all necessary introductory details about “You”

Every app development project emerges out of the team and it should also be reflected in writing an app development plan as well. Write all the elementary details about the app developers like

- A startup or organization name

- Complete address,

- Who will lead the project

- Who presented the idea and why

- App’s title

- Email, phone, or any other contact information

This is the first thing that will make your impression on venture capitalists as organized and disciplined developers. Also, this will help in easy communication and document storage.

- Define Your Application, Its Target, and Its Impact

After defining your developer’s team, project specs in your document, it's time to introduce your application and the idea in detail. Answer all these questions in your document:

- What do you want to achieve with your mobile application?

- What problem your application is going to resolve?

- How will users benefit from using your app?

- Is your app's idea workable?

- Who are your competitors?

This writing section should be elaborative and defined well to ensure there are no points left when you pitch your plan to venture capitalists. Specifying the objectives of the app, the goals you want to achieve, and what problems the app will address also indicates the vision you have for your development project.

- List Your Development Stack

Explaining your app idea, functionality and objectives is not enough. You also have to define what your technical requirements to develop the app are. Outline your technological stack the app will require to get developed. It depends on:

- Will you develop for Android or iOS or you are considering both?

- In the case of Android, which framework are you going to use for development?

- What are your UI design tools?

To list your tech stacks, you have to consult your designers and developers. It will help you in asking for significant funding required for agile and seamless app development.

- Define the Target Audience

Before you jump into the development and pitching of venture capitalists for your project, be clear about your target audience. The success of your app development project axes on identifying the target audience. Here are some demographics of your target audience you should consider including in your mobile app plan writing:

- Age, gender, and area

- The economic class of society

- Lifestyle

- Profession

- Their problems, pain points, wants, and needs

- Literacy rate either technological or educational

It will help a venture capitalist understand the app marketing budget or the size of the audience your app will cover. Also, it will be helpful for a developer to design the app's UI to cater to your target audience in a better way.

- Wireframes and Prototype of the app

Wireframes and prototypes of your app will let the venture capitalists have a visual idea of what the app will look like. So it must be included in your app development plan to make your proposal impressive, well worked, and solid.

Sketch UI, define user navigation, outline the app’s functional requirements, and consider the overall UX. You can also provide references to other apps that resonate with your idea.

P.S: the visual appeal of your app matters a lot to your users, so keep in mind your target audience while sketching prototypes, wireframes, or the app's UI.

- Define Your Competitors

For the long-term appeal and success of your app, it is pivotal to address your competitor apps. It will help you point out your standout points before venture capitalists and explain what difference your app will be offering to the users.

Explain to venture capitalists in your document how you can break the wall and provide unconventional design to attract a larger number of audiences. Also, explain how your app will compete with other apps in the long run.

- Create a timeline of the Development process

A primary timeline depicting app development process deadlines is imperative for the app development plan. Divide your timeline into several sections starting from planning, wireframes, and prototyping, developing to testing, quality assurance, and launching phase. Without a proper timeline in your written document, your venture capitalist will not trust your development project.

- Budget and App Monetization

Your app development plan must have budget breakouts as well as how you will generate revenue out of the app. It is crucial to coordinate the budget according to your project's timeline. You may require different license software for the development process. Make sure to include its cost and evaluate the overall project cost-efficiently. evaluate your app’s costs.

Similarly, the most interesting thing that attracts your venture capitalists to invest is how your app will generate revenues for them. Clearly define your app’s pricing model and monetization strategy to let them have an idea if it is worth investing in or not.

Best Practices to Pitch Your App Development Plan to a Venture Capitalist.

You have a mobile app development plan written finally to pitch for venture capitalists. Now what? How would you do that? What will be your way to get maximum funding for your project? It may become the biggest concern for you now that how to get the right investor for your app.

Many startups are facing this challenge across the globe. Maybe it seems easy, but it is not really easy to find the people who "venture" and invest in your app no matter how convincing your app's idea is.

Your app's idea may click the investors if you convince them efficiently. and it is only possible when you logically and emotionally debate your project and pitch venture capitalists perfectly.

So let’s discuss some of the practices to pitch your app development plan to venture capitalists like a pro.

- Be Ready with Your App's Prototype

A well-designed and close-to-real app's prototype must be ready before you opt for pitching your app development plan. It will be very convincing as the investors will have a better idea of how your app will work after going through its prototype.

There are a lot of benefits of being ready with your app prototype

- It shows how passionate and professional you are regarding your project

- It elaborates your vision of the app descriptively.

- It executes your app’s idea in a most effective way.

- An investor will get half convinced if your prototype is well designed.

Even creating a prototype is a lot easier, you can choose two to three user stores and design them. However, if you have some funds with you, you can hire an expert designer or app development company to help you with the design. In case, if you do not have funds, you can use UI kits as they will allow you to design instantly as a user story by simply dragging and dropping design elements.

- Explain the problem you want to address with a solution

Almost all mobile apps are the solution to any problems. That is why it is necessary to explain what problem your app is going to address. Explain the problem by keeping the target user in mind so that your investor may connect with it as a common user.

Some tips:

- Be concise with your explanation

- Don't over-explain the issue

- Research well on potential questions your investor may ask regarding the problem you are explaining.

- Your problem should be significant enough to grab the investor’s attention.

After successfully explaining your problem, now present your investors with a solid solution. Your investors already know that your app is going to solve the problem, now you just have to convince them how it will happen. You must:

- Make sure to prove your point through stats and figures

- Always highlight the significant change your app will make in your user’s life

- Don’t exaggerate, keep it simple but elaborative.

- Explain Your App’s Target Audience and Target Market

Explaining the target audience and target market will not only be helpful for investors to make their decision, but it will also help developers to create apps accordingly. You will be able to plan your project strategically by keeping in mind your app's target audience and get funding from the same niche of investors.

- Also, include your competitors in your pitching plan

Let your investors know about your competitors is the most important part of your pitching plan. It has many benefits including:

- It will make an impression that you have done a lot of market research

- It will let you execute your idea in a creative and unique way

- It will also let the investors evaluate how your idea is going to make a difference amidst great competition. It will eventually build their trust in your app.

- App pricing model or monetization method

It is the most anticipated explanation your venture capitalist is looking forward to. 99% of investors are interested in knowing how your app will generate revenues and eventually provide a great ROI. You must be very precise and specific about your budget and you have to calculate a valuable ROI that lures investors to get interested in funding your project.

There are two ways to do it:

- Show investors how effectively your app provides a solution to a problem.

- You can emphasize the point that your app will fill the void in the market.

- Fund evaluation

Never hesitate to communicate clearly about your funding needs. Break down your app's development budget in sections and explain to venture capitalists about the investment for each section and how much funds will require to achieve the next level of the development process.

Keep in mind the following points to do this:

- Discuss each stage in the development process clearly and openly to investors.

- Never overestimate your app's budget. The amount you quote should be reason enough for investors to believe.

- Always provide examples of projects of the same category of your app.

- Clearly define your goals and project timelines so that your investors will have a reason to trust your project to provide funding.

So these are best practices on how to pitch your app development plan to venture capitalists. Follow these steps religiously and you will likely increase getting investment chances.

One thing to make sure of is to be realistic about your app's idea and its goal. In that way, you will be able to convince investors easily to fund your app’s project.

Advantages and Disadvantages of Venture Capital

Before you rush into venture capital, go through some of the significant advantages and disadvantages it has:

- Startup expansion

Venture Capital is a great opportunity for startups to expand. It is far better than taking loans from banks or other financial institutes.

- Professional help and Guidance

Venture capital is not all about funds, it also lets startups get a valuable guide and professional support they may need. A venture capitalist is actively involved in all the decisions of a startup. So they readily offer their expertise in every matter that may require their concern. From building project strategies to providing essential technical assistance, they provide everything to make an app’s project successful.

- It helps to build connections and a professional network

Venture capitalists help startups with building their professional network and connection in the community. It is very beneficial for startups as it assists them in growing and nurturing in market.

- No burden on startup regarding payment

A venture capitalist invests by keeping in mind the risk factor. The “venture” in the term “venture capitalist” is for a reason. That is why a startup is not liable to pay back the amount invested by venture capitalists if the project fails. That's pretty cool. Isn't it?

- Easy to access

Venture capitalists are easy to locate and access as they are officially documented and listed. This reduces the stress for startups to find the appropriate investors for their projects.

Disadvantages of Venture Capital

- Lose Of Ownership and Control

A venture capital results in losing the startup's power to control the app development project. A venture capitalist intervenes in a company's decision according to its own interest. The capital investment is bartered with the equity of the company. Things may get chaotic if there is a difference in opinion of venture capitalists and startup owners. The consent of venture capitalists is crucial to make any decision.

- Venture Capitalist May Redeem Investment Early

A venture capitalist has the right to redeem the investment within three to five years depending on the bond signed. This means that if the app needs funding more for more than that time, it is not worth it.

- Complicated process

There is a long, complex process a startup has to go through to get venture capital. And there is no certainty of getting funding even after completing that process.

- A unique app idea is a must

Venture capitalists invest in projects that are unique as well as convincing for them. There are a lot of investment requests they keep on getting on regular bases, but they choose the one which has potential to be standout. That is why reaching venture capitalists is a tedious process and one has to be so unique to grab the attention of investors.

- Irregular funding

Your project may get approval for venture capital, but the investors may release funds at irregular intervals. It is because venture capital funding comprises a huge investment. VC set some milestones for startups to achieve to unlock further funding. This may be a pesky process for some startups.

Conclusion

No matter how great your app idea is or how expert a developer you are, one thing is certain; developing an app requires a lot of planning and a lot of investment. We have discussed how you can write an effective app development plan to pitch the venture capitalists and get funding for your app. You may have gone through the detailed article which probably has helped you regarding everything you did not know.

So, what are your thoughts about it? How will you plan your app development to pitch to investors and get venture capital funding? Do let us know through your feedback.

let’s get started!

Get in touch today. We’re ready!